Insurance – A Financial Safety Net

What is Insurance?

Insurance is a contractual agreement where you pay premiums to an insurer in exchange for financial protection against specific risks like death, illness, accidents, or damage to assets. It’s a risk-transfer mechanism that safeguards your family and finances during emergencies.

Life Insurance

Types of Life Insurance:

- Term Insurance: Pure protection with high cover at low premiums.

- Endowment Plans: Combine savings with insurance; lump sum paid at maturity or death.

- ULIPs: Market-linked plans that offer investment + insurance.

- Whole Life Plans: Cover you for your entire lifetime.

Purpose:

Protect your dependents financially in case of your untimely demise, or build savings over time (in some plans).

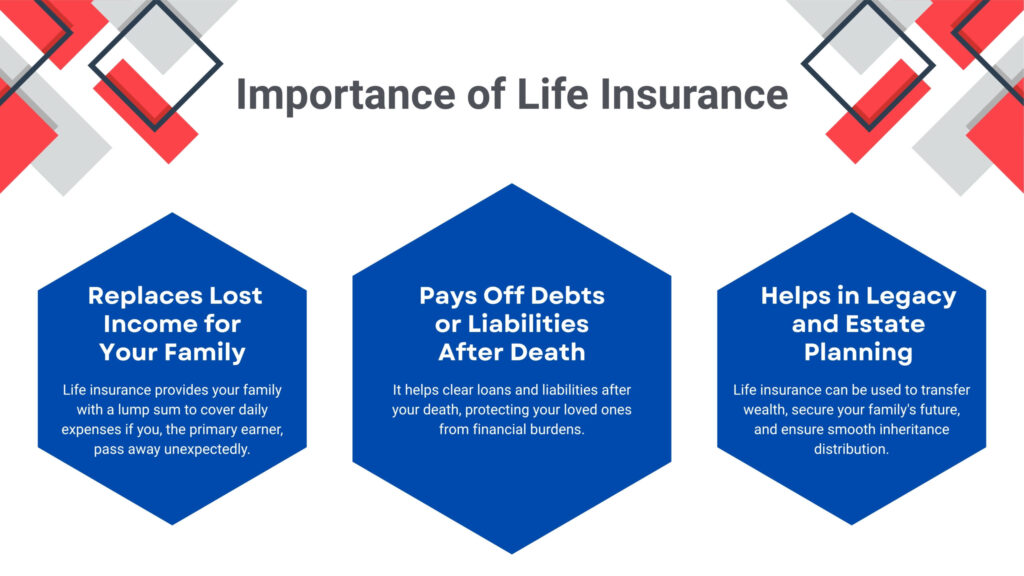

Why Life Insurance is Important?

Life insurance provides crucial financial support in your absence. It replaces lost income, helping your family manage daily expenses like rent, groceries, and school fees. It also covers outstanding debts, such as home or car loans, so your loved ones aren’t burdened with liabilities. Beyond protection, life insurance plays a key role in legacy planning—allowing you to pass on wealth, support your spouse’s retirement, or fund your children’s education, ensuring long-term financial stability for your family.

General Insurance

Types of General Insurance:

- Health Insurance: Covers hospitalization and medical expenses.

- Motor Insurance: Mandatory for all vehicles; covers accidents and damages.

- Home Insurance: Covers damages to your property from natural calamities or theft.

- Travel Insurance: Covers emergencies during domestic/international travel.

- Commercial Insurance: Protects businesses from operational and legal risks.

Purpose:

Protects non-life aspects such as health, vehicles, property, and business against unforeseen losses.

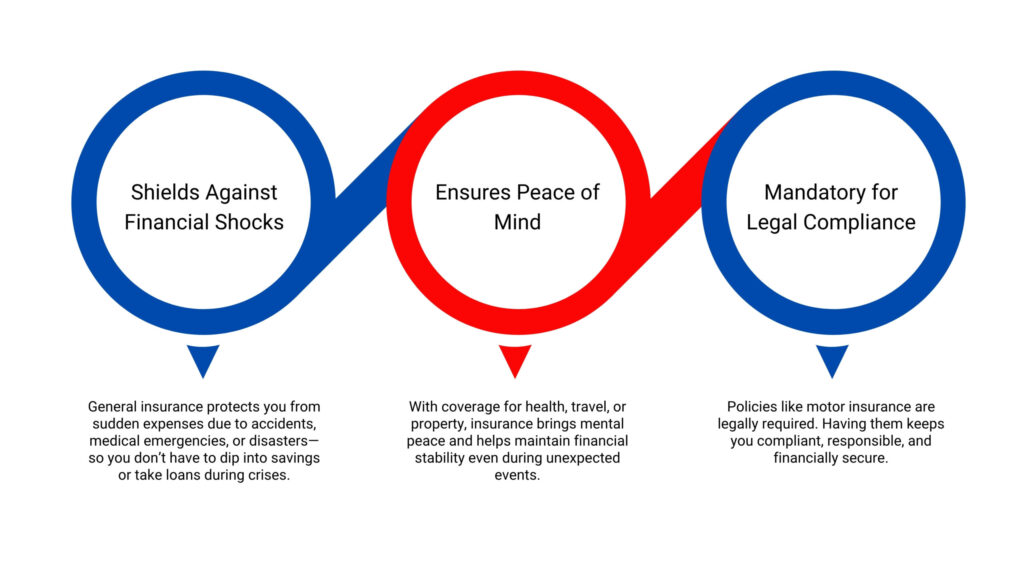

Why General Insurance Is Important?

General insurance acts as a financial safety net during unexpected events like accidents, medical emergencies, or natural disasters. It protects you from sudden expenses, ensures peace of mind, and helps maintain financial stability. In many cases, such as motor insurance, it is also legally mandatory—making it essential for both personal protection and legal compliance.

Best For:

General insurance is not a luxury, it’s a necessity.

Whether you’re a salaried employee, self-employed professional, business owner, or retiree, general insurance is an essential component of a well-rounded financial plan. Life is full of uncertainties — health emergencies, property damage, accidents, or travel disruptions can occur at any time, regardless of age, income, or lifestyle.

By covering these unpredictable risks, general insurance protects your savings, ensures financial continuity, and gives you the freedom to focus on your goals without worrying about unexpected expenses. It supports not just individuals but also families and businesses, making it relevant to everyone at every stage of life.

Whether you’re:

- A young professional just starting your career and securing your first vehicle or rental property,

- A parent safeguarding your family’s health and well-being,

- A business owner protecting commercial assets and employees, or

- A retired individual ensuring healthcare costs are covered,

General insurance is a vital financial safety net.

It complements investments and savings by offering risk protection, completing the foundation of financial security and smart planning for every individual and household.

Need the Right Insurance Protection?

Let's Help You!

Protect your life, health, assets, and income with plans that are tailored to your needs, not just your premiums. Speak with our IRDA-certified insurance experts to secure your future, risk-free.

Call Now: +91 8799065697

Peace of mind starts with the right cover.